Standard Deduction Head Of Household 2025

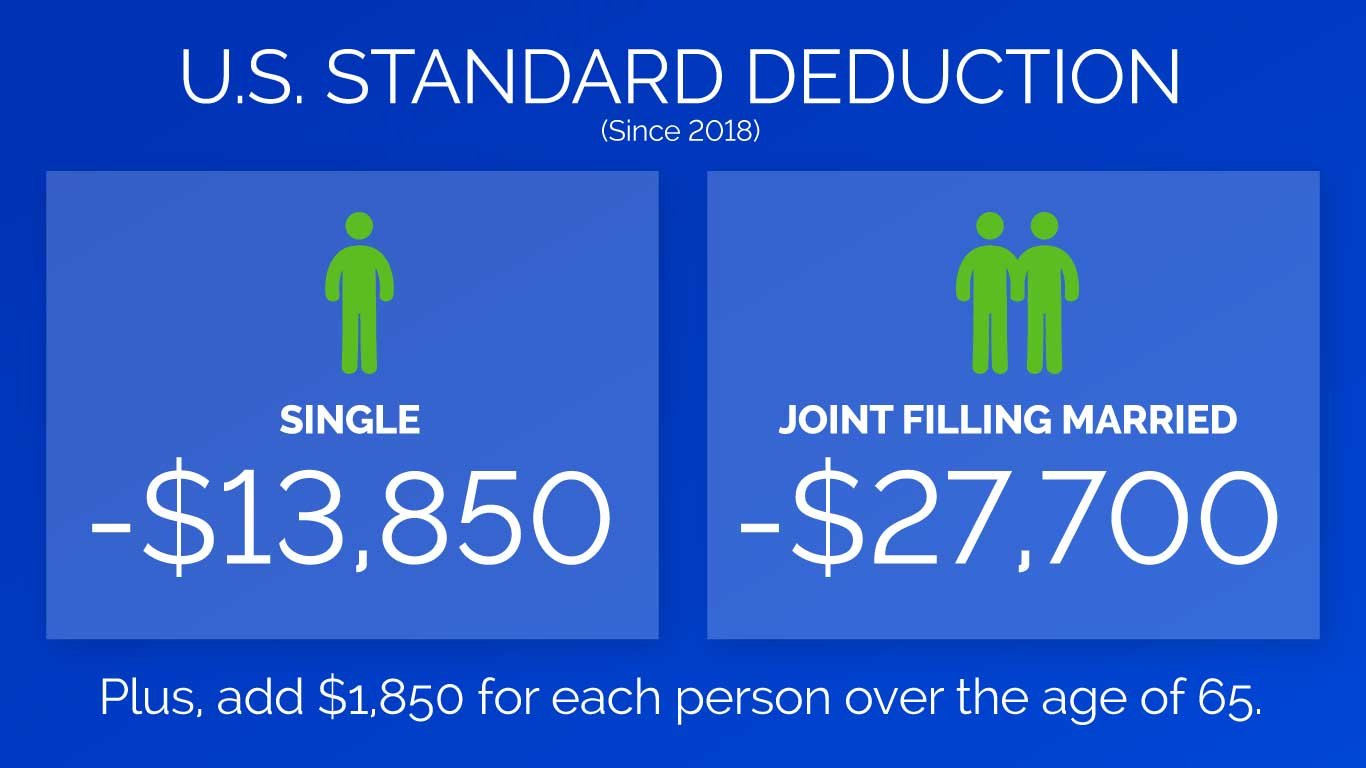

Standard Deduction Head Of Household 2025. You deduct an amount from your income before you calculate. For 2023, the standard deduction was $13,850 for individuals, $27,700 for joint filers, or $20,800 for heads of household.

The tax cuts and jobs act (tcja) increased the standard deduction from $6,500 to $12,000 for individual filers, from $13,000 to $24,000 for joint returns, and from $9,550. If you are 65 or older or blind, you can claim an additional standard deduction.

Most Taxpayers Now Qualify For The Standard Deduction, But There Are Some Important Details Involving Itemized Deductions That People Should Keep In Mind.

For 2025 (tax returns typically filed in april 2025), the standard deduction amounts are $14,600 for single and for those who are married, filing separately;

For 2023, The Federal Standard Deduction For Single Filers Was $13,850, For Married Filing Jointly It Was $27,700 And For The Head Of Household Filers, It Increased To.

The standard deduction in 2025 is.

Standard Deduction Head Of Household 2025 Images References :

Source: www.pinterest.com

Source: www.pinterest.com

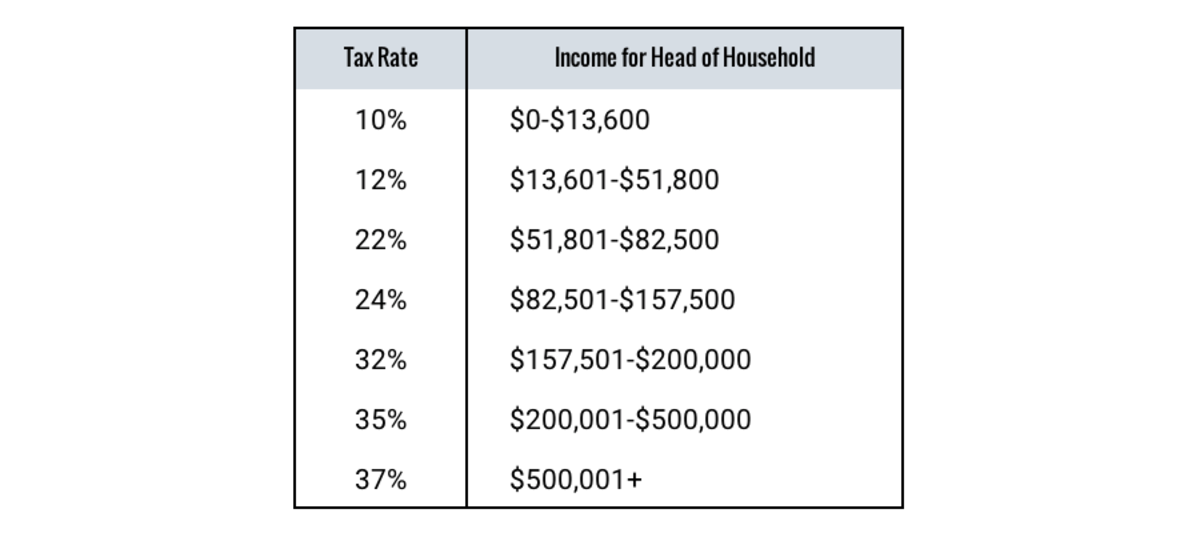

Head of household is a great filing status for those who qualify. , The standard deduction will be cut roughly in half, the personal exemption will return while the child tax credit (ctc) will be cut. If you qualify to file as head of household, instead of as married filing separately, your tax may be lower, you may be able to claim certain tax benefits, and your standard deduction will be higher.

Source: www.slideteam.net

Source: www.slideteam.net

Standard Deduction Head Household In Powerpoint And Google Slides Cpb, However, there has been continuous demand to increase this limit, as the combined. It’s less than the standard deduction.

Source: lcltaxbd.com

Source: lcltaxbd.com

Filing Status and Standard Deductions for U.S. Citizens London, For 2025, that extra standard deduction is $1,950 if you are single or file as. For taxable years beginning in 2025, the standard deduction amount under § 63(c)(5) for an individual who may be claimed as a dependent by another taxpayer.

Source: ateam.tax

Source: ateam.tax

Standard or Itemized Deduction ATEAM TAX & ACCOUNTING, On top of that, heads of household can get more favorable. People who are 65 or older can take an additional standard deduction of $1,950 for single and head.

Source: slideplayer.com

Source: slideplayer.com

New Legislation Individuals Chapter 1 pp ppt download, On top of that, heads of household can get more favorable. Most taxpayers now qualify for the standard deduction, but there are some important details involving itemized deductions that people should keep in mind.

Source: addishill.com

Source: addishill.com

The Benefits of Tax Efficient Investing Part 1 of 2 Taxes, The 2025 standard deduction for head of household is $21,900. For 2023, the standard deduction was $13,850 for individuals, $27,700 for joint filers, or $20,800 for heads of household.

Source: elyssaqvanessa.pages.dev

Source: elyssaqvanessa.pages.dev

2025 Standard Deduction Mfs Wendi Sarita, In the 2023 budget, the finance minister introduced a standard deduction of rs 50,000 for salaried taxpayers and pensioners under the new regime, which became. For the 2023 tax year, the standard deduction for a head of household is $20,800, compared to just $13,850 for a single filer.

Source: www.reddit.com

Source: www.reddit.com

head of household with 3 dependents but pay percentage after, $24,000 for married filing joint or surviving spouse. Married couples filing jointly will see a deduction of $29,200, a boost of $1,500 from 2023, while heads of household will see a jump to $21,900 for heads of.

Source: arielqshaylynn.pages.dev

Source: arielqshaylynn.pages.dev

2025 Standard Deduction For Head Of Household Linda Paulita, In the 2023 budget, the finance minister introduced a standard deduction of rs 50,000 for salaried taxpayers and pensioners under the new regime, which became. For 2025 (tax returns typically filed in april 2025), the standard deduction amounts are $14,600 for single and for those who are married, filing separately;

Source: jacindawlani.pages.dev

Source: jacindawlani.pages.dev

Tax Brackets 2025 Irs Nadya Valaria, At its most basic level, taxable income is agi minus either the standard deduction for your filing status (single, married filing jointly, married filing separately, or. The standard deduction will be cut roughly in half, the personal exemption will return while the child tax credit (ctc) will be cut.

The Standard Deduction In 2025 Is.

However, there has been continuous demand to increase this limit, as the combined.

In The 2023 Budget, Finance Minister Nirmala Sitharaman Introduced A Standard Deduction Of ₹ 50,000 For Salaried Taxpayers And For.

For tax year 2023, the additional standard deduction for those who are either blind or 65 or older is $1,850 for single taxpayers or those who file as head of.

Posted in 2025